Each week, we'll bring you select insights from our newsletter, How to Build Brands and Influence People (HBBIP). To have all of these insights delivered directly to your inbox, subscribe today!

With almost twenty of these newsletters under my belt—time flies when you’re having fun—I’ve developed a handy rubric to determine whether a brand is worthy of inclusion in these hallowed pages: if this brand has increased its EMV in each successive year for the last three to five years, then it’s probably doing something right. And if it’s a globally recognized name that just so happens to lead its vertical, well, all the better.

Which begs an important question: how have I not talked about Red Bull already?

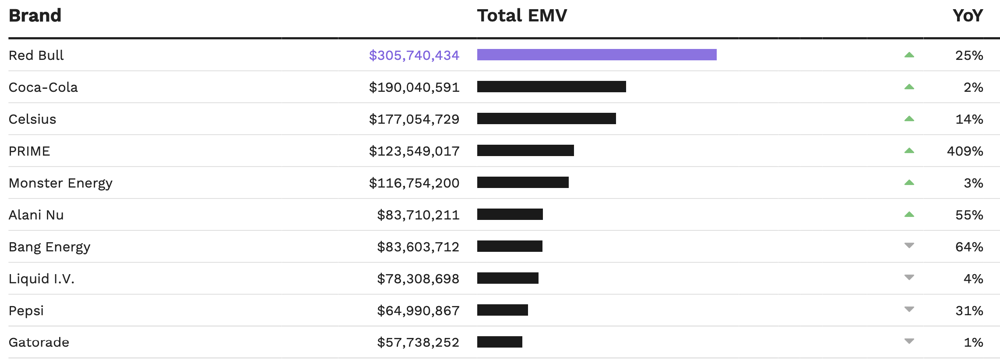

Check out this classic HBBIP™️ graph:

Red Bull Performance 2018-2023 by EMV

Red Bull Performance 2018-2023 by EMV

In a mere five years, Red Bull surged from just shy of $50M EMV to just north of $300M EMV. You might not have noticed, but that second number is a good degree bigger than the first!

Related: The Hottest Alcohol Brand You’ve Never Heard Of, and More News You Can Use

Is that enough to rocket Red Bull to the top of our Non-Alcoholic Beverages leaderboard?

Non-Alcoholic Beverages Leaderboard 2023, With Red Bull in the Lead

Non-Alcoholic Beverages Leaderboard 2023, With Red Bull in the Lead

In what should come as no surprise to anyone who reads our TTTs, which is hopefully all of you, the answer is yes. But what is Red Bull doing to set itself apart?

It wouldn’t be HBBIP if I didn’t ask that sort of rhetorical question. And it definitely wouldn’t be HBBIP if I didn’t do my best to answer.

Essentially, Red Bull has found viral success by partnering with everything and everyone ~extreme~. In investigating key content trends for the brand, both in 2023 and earlier, posts abound from the world of sports: Formula 1 racing, competitive esports, the World Surf League, and more.

Because many of Red Bull’s top content streams maintain notable popularity on YouTube and Facebook, these platforms drove a pronounced percentage of the brand’s total. Out of Red Bull’s $305.7M EMV, YouTube and Facebook accounted for a respective $30.8M EMV (roughly 10%) and $18.7M EMV (roughly 6%). This might not seem like a lot, but there are two notable things here:

- One, these are both higher proportions than I typically see in other industries.

- Two, YouTube and Facebook over-index for Red Bull, producing some of the brand’s most impactful pieces of content:

- YouTube accounted for six of Red Bull’s top 10 EMV-driving pieces of content, while Facebook chipped in the other four.

- Expanded to the top 20 posts, it’s 12 for YouTube, seven for Facebook. TikTok is the outlier single post.

This is a big difference from the world of beauty and fashion, where Instagram and TikTok dominate. It’s even more pronounced than the typical proportions we (I) see amongst other food and beverage brands.

In fact, particularly when it comes to Red Bull’s Facebook EMV, it reminds me most strongly of the figures typically seen for sports teams.

While much of Red Bull’s sports- or competition-related content was impactful, garnering significant EMV, it bore only a tangential connection to Red Bull’s product, and instead reinforced the brand’s status as a sponsor to a diverse (but consistently ~extreme~) array of organizations.

Take Red Bull’s No. 1 EMV-driver in the U.S. for 2023: gaming YouTuber and esports competitor Martin Foss Andersen (MrSavage). Mr. Andersen/Savage inspired $13.4M EMV, almost double the $7.8M EMV driven by the brand’s No. 2 advocate, breakdance video production company Stance Elements. However, the vast majority of Andersen’s 251 videos mentioning Red Bull did so only via the inclusion of the phrase “I am officially a Red Bull athlete!” in the description, along with a link to the brand’s website.

Initially, I took this lack of product specificity as a bad sign for Red Bull. If creators aren’t talking about the product, is it really reaching consumers via substantive, authentic content? Then I did more research, and realized that the energy drink game operates a bit differently.

Competitors like Celsius, PRIME, Monster Energy, and more are dominating the Non-Alcoholic Beverage leaderboard by partnering with organizations and creators far outside the Non-Alcoholic Beverage space. Whether it’s Celsius’ work with bodybuilders or PRIME’s work with boxers or Monster Energy’s work with supercross and motocross creators, energy drink brands have carved out a niche in a specific field and with a specific demographic, and for the most part it’s going swimmingly.

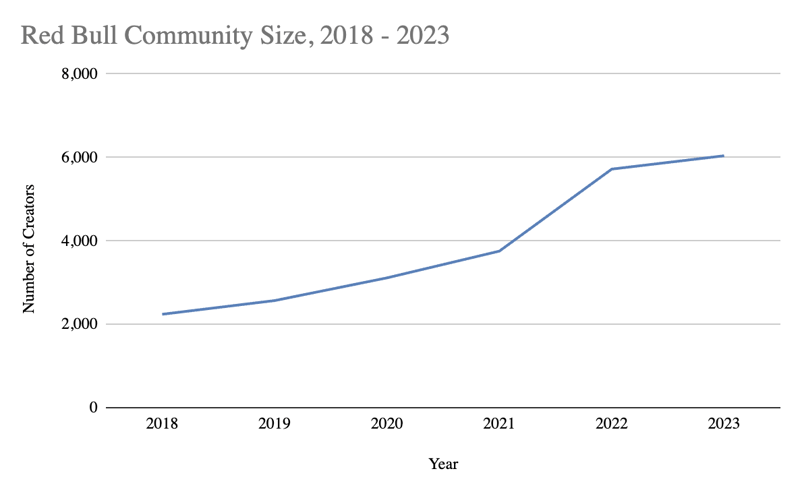

Know how I know? Why, charts, of course. Like these ones:

Number of Creators for Red Bull from 2018-2023

Number of Creators for Red Bull from 2018-2023

That’s a very healthy community growth for Red Bull, especially between 2021 and 2022. However, what’s particularly impressive about this chart comes in combination with this next one:

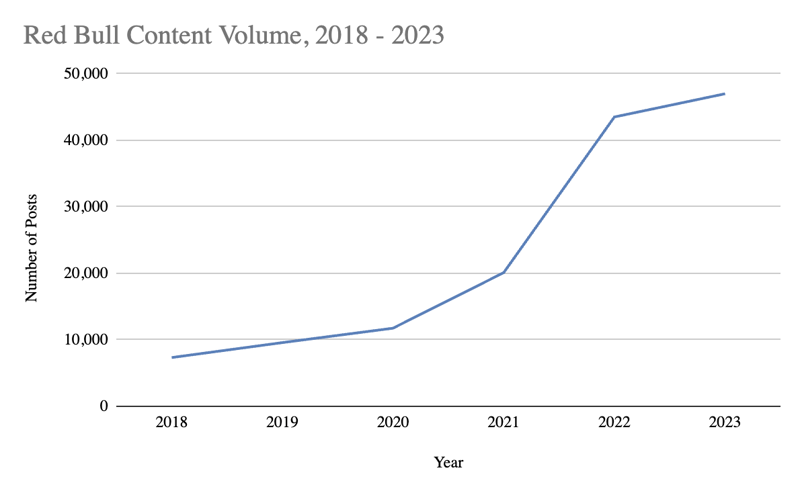

Number of Posts for Red Bull from 2018-2023

Number of Posts for Red Bull from 2018-2023

Here’s the content volume that Red Bull is seeing each year. Notice how the curve is much steeper than the community graph? Essentially, this means that Red Bull creators are posting about the brand on an extremely consistent basis. Rather than rounding out its community with transactional creators, Red Bull is achieving lasting partnerships.

So if creators don’t mention the beverage, but talk about the brand all the time, what’s the harm? After all, Red Bull is more than just a beverage—it’s (don’t say it, don’t say it, don’t say it) a way of life. (Darn it.) But actually though: whether we’re talking about Red Bull’s sports teams or dance squads or even its fashion line, the brand is much more than an aesthetic can of vaguely citrus-flavored energy, or a partner for vodka.

Not only is this newsletter (hopefully) a learning experience for you, it also teaches me a lot. Now I know what success looks like in the energy drinks space, and now I understand how Red Bull got its wings.