Each week, we'll be bringing you select insights from our newsletter, How to Build Brands and Influence People (HBBIP). To have all of these insights delivered directly to your inbox, subscribe today!

At CreatorIQ, we pride ourselves on being multifaceted. With clients across a broad range of industries, you never know what sort of data request is going to come in on any given day. Some days I’m writing about the hottest brand in Korean haircare; other days I’m researching the top automotive brands in Mexico. That grab-bag quality is part of what makes my job so fun—hopefully it livens up this newsletter a bit, too.

Perhaps no piece of CreatorIQ content, this newsletter included, reflects our breadth of verticals better than The Top 10 (TTT). After sitting pretty at Beauty and Fashion for roughly three years, we recently expanded to include:

- Better NFL and MLB coverage than your local service provider

- Enough Food & Beverage content to stock a mid-size picnic

- Streaming Service write-ups more reliable than, you know, streaming services

- That’s it (for now), but I wanted this acrostic to spell out ‘BEST,’ so here we are

Now, just in time for opening day, we’re unveiling two additional verticals:

- NBA

- NHL

Six letters, sixty-two teams, endless potential.

Inside the NBA (don’t sue pls)

Stop me if you’ve heard this one before: the media is overrating the Lakers.

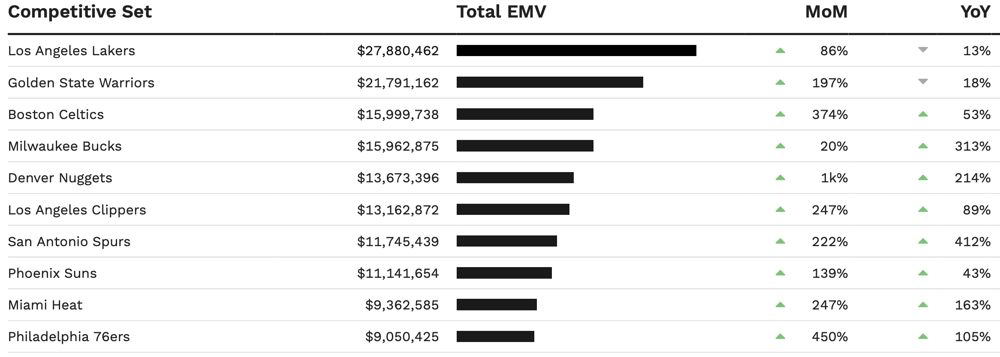

Top 10 NBA Teams in October 2023 by EMV

Top 10 NBA Teams in October 2023 by EMV

While other analytics might not like the Lakers’ chances, EMV is a big fan. It makes sense: when you combine one of the most storied franchises in all of sports, one of the greatest athletes in history, and a global capital of media and entertainment, you’re bound to garner a lot of mentions on social.

Plus the Lakers have LeBron! I was talking about Austin Reaves before, obviously.

(To all the folks who loved last week’s newsletter about Glow Recipe but are a bit confused now, that was a very funny basketball joke. Please keep reading.)

The usual suspects follow from there: a combination of playoff teams, teams with superstars, and the San Antonio Spurs, who drew interest after drafting Victor Wembanyama, a potential generational franchise cornerstone and part-time Slenderman cosplayer. A few things worth noting:

- Mile-High Growth:

With much of October’s NBA content paying homage to reigning champions, the Denver Nuggets saw the highest month-over-month surge in EMV.

- Numbers on the Board:

With the exception of the Lakers and the Warriors, both of whom saw slight YoY declines, top 10 teams were up big-time across the board, demonstrating heightened momentum for the NBA on social.

- Lonely at the Top:

It’s pretty remarkable just how far ahead of the pack the Lakers and Warriors are. The distance between the Lakers at No. 1 and the Warriors at No. 2—roughly $6M EMV—is about the same as the distance between the Warriors and the No. 3 Boston Celtics, and then the No. 3 Celtics and the No. 10 Philadelphia 76ers.

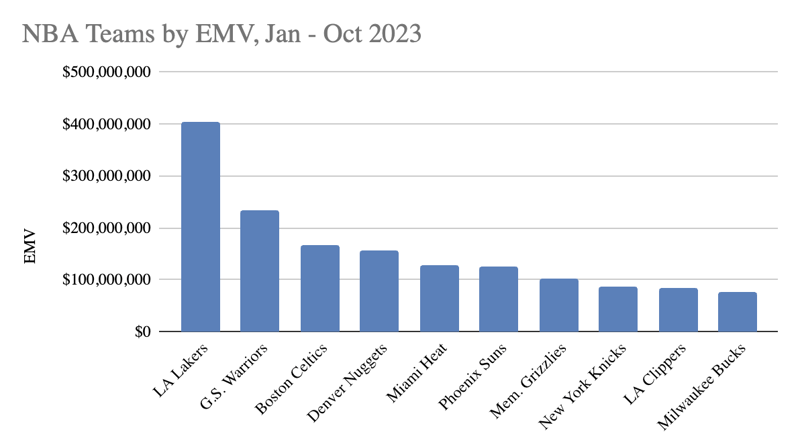

These trends bear out when we investigate the top 10 NBA teams by EMV for January to October 2023:

Top NBA Teams from January 2023 - October 2023 by Earned Media Value

Top NBA Teams from January 2023 - October 2023 by Earned Media Value

What stands out as notable for these YTD metrics?

- Two new teams emerge! The Memphis Grizzlies and my very own New York Knicks. The Grizzlies likely make the cut because of their star point guard Ja Morant’s killer Instagram content, while the Knicks are in there because we’re winning it all this year, baby. (Realistically, it’s because 2022-2023 was our best—read, our only good—season in a decade.)

- In this second round of data, the Grizzlies and the Knicks replace the Spurs and the 76ers. Why? Well, the Spurs really only heated up following the NBA Draft in June, so most of their growth has been in recent months. As for the 76ers, by this point they’re just conditioned to drop out in the second round of anything.

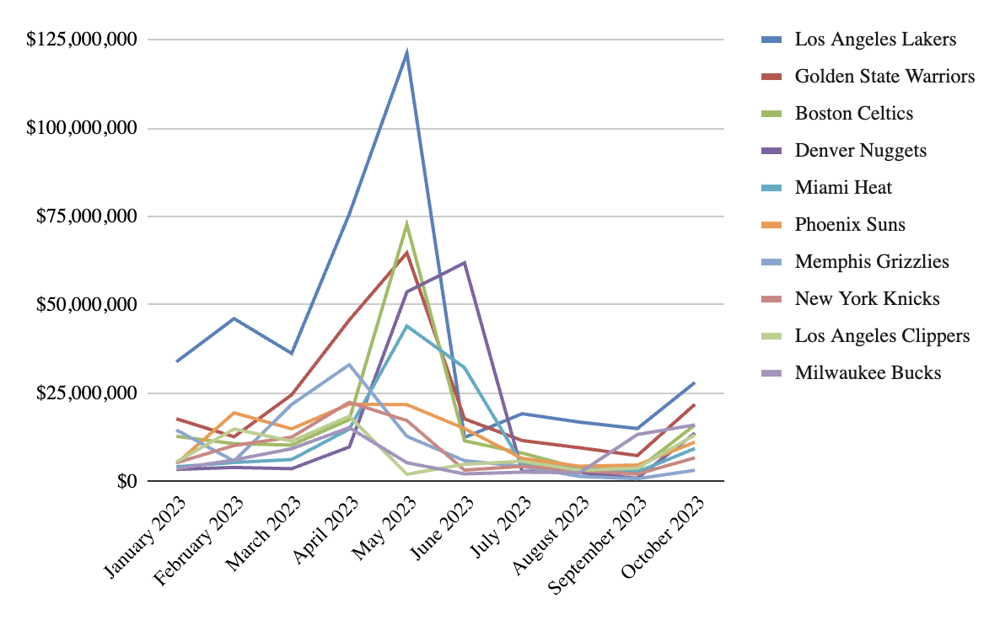

How do things look when we investigate the year as a whole?

Top NBA Teams YTD including Grizzlies and Knicks

Top NBA Teams YTD including Grizzlies and Knicks

If history is any guide, we’re in an opening-month uptick that will correspond to steadily rising interest throughout the season, culminating in an explosion during the playoffs. And once again, the very idea of the Lakers potentially winning a championship will generate more EMV than whichever team actually does win.

Because I never hesitate in my quest to bring you only the finest data and insights, I took a look at Engagement and Impressions, and found that they tell pretty much exactly the same story as EMV, so I’m not going to include any charts here. One semi-notable thing is that the Brooklyn Nets break into the top 10 teams by 2023 Impressions, deposing the Milwaukee Bucks. I don’t know if that was 100% due to Kyrie Irving’s social posts, which were heard in all four corners of the globe, but it probably helped.

Enter the Penalty Box: Insights From the NHL

I’ve got to level with you, folks: I don’t follow the NHL as closely as I follow some other sports, so this is going to be just as much of a learning experience for me as it is for some of you. I’m skating on thin ice here, but let’s see what we’ve got for October in the NHL:

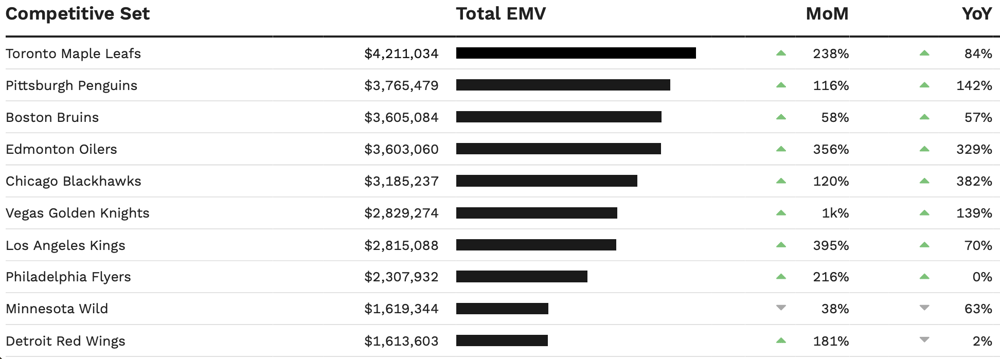

Top NHL Teams in October 2023, including Toronto Maple Leafs

Top NHL Teams in October 2023, including Toronto Maple Leafs

Upon initial review, these all do seem like actual hockey teams, which is a promising start. (Thank you again to the CIQ Data Ops team for working with me as we figured out that the New York Rangers did not, in fact, just win the World Series.)

We’ve once again got a championship bump at work, with the Vegas Golden Knights boasting a standout month-over-month EMV as the season begins. As with the NBA, most of these teams are up YoY, though I’m not sure what’s going on in the Upper Midwest to have the Wild and Red Wings declining. It’s also clear that the NHL is knotted more tightly than the NBA, with less distance between No. 1 and No. 10.

Compared to the NBA, there’s a bit more variation in top October teams versus top teams for the year as a whole:

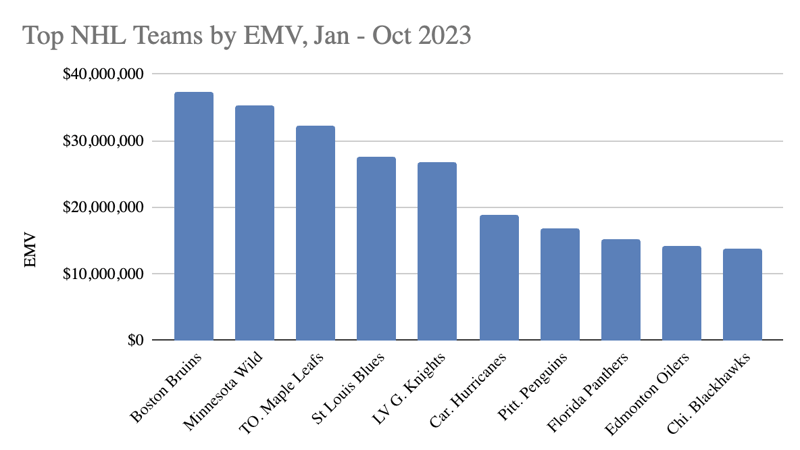

Top NHL Teams January - October 2023 by Earned Media Value

Top NHL Teams January - October 2023 by Earned Media Value

With the season kicking off, the St. Louis Blues, Carolina Hurricanes, and Florida Panthers are garnering less buzz in October than they had through the year thus far. Meanwhile, the Toronto Maple Leafs are on the up-and-up: despite ranking No. 3 for the year in EMV, the team ranked No. 2 in Impressions (324.0M, behind the Minnesota Wild’s 354.5M) and No. 1 in Engagement (23.6M).

One other thing about the NHL: its social chatter is based in large part on results, not pre-existing sentiment about teams. While over in the NBA, the Lakers, Warriors, and Celtics all saw EMV peaks higher than the Nuggets’ surge after winning the championship, it was a different story in hockey, where the Vegas Golden Knights stood alone in their success:

YTD Monthly Timeline for Top NHL Teams in 2023, including Vegas Golden Knights

YTD Monthly Timeline for Top NHL Teams in 2023, including Vegas Golden Knights

As both the NBA and NHL seasons progress, we’ll be sure to check in and follow the key stories and data points driving conversation across both leagues. Who knows—maybe the newsletter will even become sports-themed? (Disclaimer: it won’t.) In the meantime, brushing up on my hockey humor will be my main…goal.

This Week’s Headlines

Meta and Amazon Team Up to Take Over Even More of the World

Key Takeaways:

-

- Might as well just surrender your wallet now. Thanks to a feature that connects users’ Facebook and Instagram profiles to their Amazon accounts, you no longer have to navigate to a separate app to buy something you see in an ad.

- Many in the space are describing this development as “the most significant ad product of the year,” and further proof of Meta’s rebound under an increased focus on AI.

- Snapchat is reportedly set to introduce its own Amazon integration, which sent Snap stock soaring over the past week.

The CIQ Perspective:

-

- This is a massive development in the social commerce space, and another indication of Meta’s continued jockeying against TikTok.

- We’re not surprised to see this change, which has been in the works for a while. As we enter new verticals like sports, Facebook has re-asserted itself as a major driver of digital conversation alongside TikTok and the Meta-owned Instagram platform. Now Meta looks to be an even more dominant force in e-commerce.

- We’ll be sure to keep track of these developments, and guarantee that their ramifications are reflected in CreatorIQ’s product suite.

Conor's Corner

If there’s anyone on earth who lives, breathes, and truly believes in the Creator Economy, it’s Conor Begley: CreatorIQ’s Chief Strategy Officer, and a burgeoning creator in his own right. When he’s not trying to turn me into a podcaster, Conor shares his exclusive research on trending creator marketing stories with his followers on LinkedIn. But you can check out his latest findings right here.

This week, Conor shares key takeaways from his presentation at CreatorIQ Connect:

12 years of learnings and 2 years of work in one (mostly coherent) 20 minute talk. I'll cover what the best are doing and why it matters.

This is from our massive Connect event and MAN does it feel official 🤩. We're all grown up!

What are the best doing❓

1️⃣ They are working with creators at scale. Typically thousands. In some cases tens of thousands

2️⃣ They invest early. Small creators grow into big creators over time.

3️⃣ They leverage their audience and distribution (web, social, email) to grow the creator's audiences.

4️⃣ They retain their creators year after year. Retention is the #1 predictor of growth in creator content (EMV) about your brand.

5️⃣ They integrate creator content throughout the funnel - web, ads, email because it performs better. It doesn't end with the post, it starts with it.

6️⃣ Programs are in house, but with partner support. Gifting and seeding. Affiliate. Creative. Recruitment.

7️⃣ As programs scale into the enterprise, the need for measurement standards, compliance, and brand safety has increased dramatically.

💰 We also show the impact it is having on Celsius ($13B valuation), PRIME ($250M in revenue), MLB (best attendance growth since 1998), SKIMS ($750M in revenue), Barbie ($1.4B at the box office), Alo Yoga ($1B in revenue), Amazon (188k creators 👀 ), Naturium ($355M acquisition), Fashion Nova (est. $1-4B in revenue), and Rare Beauty (est. $300M in revenue up 200% YoY). Who also all happen to be clients 😃

🙏 Thank you to our clients and the industry leaders for tens of thousands of meetings with us over the last decade+ that have helped shape our knowledge and to our team for always striving to understand this space more deeply.

I hope you enjoy!

*Go to 50 seconds in if you want to skip the shout out for my wife ❤️

**There are dozens more talks from that day published now as well!

To get all of these stories, plus much more, delivered to your inbox weekly, be sure to subscribe to our newsletter.