Each week, we'll be bringing you select insights from our newsletter, How to Build Brands and Influence People (HBBIP). To have all of these insights delivered directly to your inbox, subscribe today!

Given that this newsletter and resulting blog series exist, it probably comes as no surprise that the creator economy is continuing to rise. In 2023, we saw proof of that rise everywhere we looked.

Brands across verticals found bold new ways to work with creators, who in turn reached consumers across an increasing array of platforms. Meanwhile, out in the so-called ‘real world,’ more than ever before, creator culture permeated the mainstream, becoming synonymous with pop culture and news at large. Look no further than Swift/Kelce-mania, RHODE Skin’s emergence (and Krispy Kreme tie-in), or what the Barbie phenomenon did for beauty: the year’s top stories were stories fueled by creators.

But specific commonalities and themes emerge when we look at the official Top 10s for Cosmetics, Skincare, Haircare, Luxury Fashion, and Apparel. And then, even more key takeaways emerge when considering the other verticals I’ve examined. Putting it all together, we can come away with a profile for the type of brand that succeeded in 2023, and that’s poised for further success in 2024.

But first, a little history lesson.

Cosmetics

Top 10 Cosmetics Brands in 2023 by EMV

Top 10 Cosmetics Brands in 2023 by EMV

A few things jumped out at me here. One, as I’ve written about before, is that Rare Beauty is crushing it. The brand has ascended to No. 1 in our rankings by a fair margin, and shows no signs of slowing down.

The other is that, after a few tenuous years during the Pandemic, Cosmetics appears to be fully back. Nine out of ten brands displayed solid YoY growth, which was by no means a given from the looks of things several years ago. Don’t believe me? Perhaps you’ll believe NUMBERS:

Top 10 Cosmetics Brands Average YoY EMV Growth from 2020-2023 by EMV

Top 10 Cosmetics Brands Average YoY EMV Growth from 2020-2023 by EMV

As you can see, Cosmetics’s top brands were underwater in 2020 and 2021 during the height of the Pandemic. However, the industry has rebounded since then, with new stars like Rare Beauty emerging to fuel a new generation of content creators.

I’ll go into some of the reasons for Cosmetics’ growth—and the growth we’re seeing more broadly—in the “Summing It All Up” section. But don’t skip ahead just yet: we’ve got more fun vertical findings for you. Such as…

Skincare

Top Skincare Brands in 2023 by Earned Media Value

Top Skincare Brands in 2023 by Earned Media Value

We’re seeing crazy growth in skincare—the lowest YoY growth in the skincare Top 10 is on par with the highest growth in Cosmetics, outside of Rare Beauty. We’re also seeing the triumphant return of Drunk Elephant, a former perennial favorite that’s risen back up the ranks. RHODE Skin, of course, stole the show in 2023, claiming the year’s top YoY growth.

Let’s take a deeper look at the industry’s growth over the past several years:

Top 10 Skincare Brands Average YoY EMV Growth from 2020-2023 by EMV

Top 10 Skincare Brands Average YoY EMV Growth from 2020-2023 by EMV

Now that’s a wild ride. Skincare surged in 2020, when the stress of that whole ‘society as we know it crumbling’ thing drove people to apply a different sort of facemask. If we’re all going to die, we might as well moisturize.

But then, post-2021, skincare became increasingly tied to the ~*wellness*~ movement, which has permeated all aspects of contemporary consumerism. When coupled with standout brands like RHODE Skin, this has led to a true renaissance for skincare.

Will RHODE Skin claim the No. 1 spot in 2024? It wouldn’t surprise me: in putting together this investigation, I found that skincare is the only vertical discussed in this blog post that’s seen a different No. 1 brand in each calendar year since 2020: Tatcha, TULA, Glow Recipe, and now Drunk Elephant.

Related: Watermelon Glow and Strawberry Glaze: How Glow Recipe and Erewhon Win With Influencer Marketing

Haircare

Top Haircare Brands in 2023 by Earned Media Value

Top Haircare Brands in 2023 by Earned Media Value

2023 saw solid returns across the board for haircare, with seven out of 10 posts surging. K18 Hair showed that it was acquired for a reason—that reason being both science and TikTok—while Gisou positioned itself as the next big haircare brand to watch.

One casual observation I made was that brands with a large professional/salonist network seem to be, generally speaking, a bit less in vogue than haircare brands that emphasize either science-backed formulas, a la K18 Hair, or ties to the world of beauty, a la Gisou.

Last year also saw a local highpoint for haircare, after several years of relatively flat returns:

Top 10 Haircare Brands Average YoY EMV Growth from 2020-2023 by EMV

Top 10 Haircare Brands Average YoY EMV Growth from 2020-2023 by EMV

Time will tell whether this graph shows the part of the roller coaster where you start to get scared, or some sort of infinite funicular (dibs on that as a band name). But for now, haircare is in a strong position of steady growth, with several top brands distinguishing themselves in 2023.

Related: Why Unilever Acquired K18 Hair

Luxury Fashion & Apparel

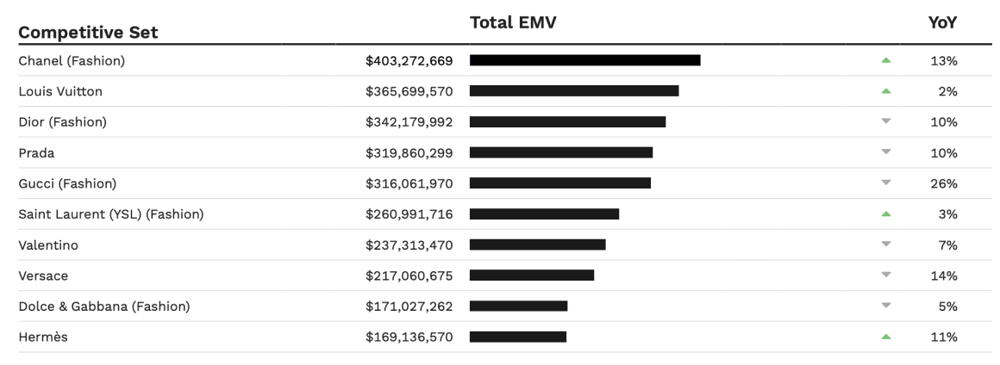

Top 10 Luxury Fashion Brands in 2023 by Earned Media Value

Top 10 Luxury Fashion Brands in 2023 by Earned Media Value

There have been better days for luxury fashion. Such as, say, the entirety of 2021:

Top 10 Luxury Fashion Brands Average YoY EMV Growth from 2020-2023 by EMV

Top 10 Luxury Fashion Brands Average YoY EMV Growth from 2020-2023 by EMV

After a 2020 that saw most luxury fashion events shut down, rendering content about these brands a little homebound, the industry came roaring back in 2021. However, luxury fashion has struggled to match that momentum since then, though a few brands, like Chanel and Hermès, stood out in 2023.

It’s a similar story in Apparel:

Top 10 Apparel Brands in 2023 by Earned Media Value

Top 10 Apparel Brands in 2023 by Earned Media Value

In times like these, so full of strife and uncertainty, I take comfort in the fact that the Kardashians are continuing to profit.

How about historically? Is apparel faring better there?

Top 10 Apparel Brands Average YoY EMV Growth from 2020-2023 by EMV

Top 10 Apparel Brands Average YoY EMV Growth from 2020-2023 by EMV

Oh. It’s the part of the roller coaster where you start to get less scared.

Remember when you bought all that athletic gear and loungewear in the early days of the pandemic, for all your home-workout and lounging needs? Well, this graph also shows how often you put that gear to use over the years.

Still, hope remains for both luxury fashion and apparel. K-Pop stars have emerged as a major EMV-driver for savvy brands, while those that collaborate with beauty brands, or have a presence in that market, tend to perform well. And if all else fails, you can still try to work with a Kardashian.

Summing It All Up

As promised, here’s are the key factors that distinguished growing brands in 2023, and the metrics to look for when determining brands that are likely to carry that momentum into 2024:

Surging TikTok Figures

Instagram is king for now, but TikTok is fueling more momentum. Instagram might drive 60-80% of the average brand’s EMV, compared to 20-40% for TikTok. However, top brands are seeing 10-30% YoY growth in Instagram EMV, and >100% YoY growth in TikTok EMV. With TikTok taking up an ever-greater share of the pie, and even Instagram content looking like TikTok now, expect for this trend to continue this year.

A Focus on Engagement

It’s not about how many eyes see you, but how long those eyes keep looking—or something like that. In looking through 2023 trends, I found that Impressions, which measures content views, doesn’t always correlate with growth. Instead, Engagement, which measures content interactions, is becoming increasingly indicative of overall brand health. This scans with a broader move from sponcon to ‘authenticity,’ with creators—and savvy brands—prioritizing genuine interaction and resonance over drawing a wider audience. In other words, to see which brands are poised to grow, look to Engagement.

Interdisciplinarity

Sorry to throw a buzzword at you, but in this case it’s more than just buzz (it’s…a word?). Content performs—and brands win—when audiences from multiple verticals mix. This isn’t a new idea, but we saw it in action more than ever throughout 2023, with the year’s top brands and initiatives throwing together some pretty offbeat pairings. Just think of:

- RHODE SKIN + Krispy Kreme

- Skims + NBA

- Every skincare brand + whatever ‘wellness’ even means now

- The entire American pop culture and media hype machine + the Kansas City Chiefs

In 2024, we’ll be looking for more TikTok content, more authentic and engaging content, and of course, more unconventional team-ups. I’m hoping to see Grimace walk the runway at Dior’s PFW show, or Charli D’Amelio to start dating Shohei Ohtani. I can’t say whether those things would make for successful brand campaigns, or a reality worth living in, but hey—they’d make for one heck of a newsletter.

This Week’s Headlines

Brands Go Long on YouTube Shorts

Key Takeaways:

-

- As reported by Business Insider, brands are investing more heavily in YouTube Shorts, which is part of a broader movement toward short-form video content.

- This push for short-form content stems in turn from increasing recognition of influencer marketing’s value for brands.

- While YouTube Shorts is on the rise, Instagram is still the platform of choice for most creators. Twitch and Snapchat are also surging, providing a range of short-form video options for creators and consumers alike.

The CIQ Perspective:

-

- If all of the above already sounds a lot like CIQ’s perspective, well, that’s because it is. Business Insider asked us for the data underpinning this article, and we happily provided it.

- They even quote some hack named “Alexander Rawitz,” but I don’t think he’s very trustworthy.

- Just plain old ‘Alex’ is fine for a rag like this blog, but to classy establishments like Business Insider, it’s “Alexander.”

How to Succeed at Customer Success

Key Takeaways:

- From our friends at Built In—your go-to resource for tech and human resource content—comes a notable article about how to break into the burgeoning field of Customer Success Management (CSM).

- CSMs have to navigate product expertise, client-facing skills, and strategic thinking to guarantee the best possible experience for customers. It’s a complex, often thankless role, but one that’s becoming increasingly popular in the world of tech.

- To get to the nuts and bolts of what a good CSM does, Built In wisely chose to interview one of the best CSMs I know: CreatorIQ’s very own Raphael Vizcarra.

The CIQ Perspective:

- Raph describes what it takes to be a great CSM, especially in an industry as vast and ever-changing as influencer marketing: in a single word, passion.

- He also identifies the key traits that every CSM should possess: verbal and written communication skills; the ability to think both strategically and creatively; and exceptional time management.

- The whole article is worth a read, but if you’re going to choose just one section, maybe try the interview with Raph.

Conor’s Corner

If there’s anyone on earth who lives, breathes, and truly believes in the Creator Economy, it’s Conor Begley: CreatorIQ’s Chief Strategy Officer, and a burgeoning creator in his own right. Conor shares his exclusive research on trending creator marketing stories with his followers on LinkedIn. But you can check out his latest findings right here.

This week, in the spirit of 2023’s top brands, and hot names to expect in 2024, Conor walks us through the virtues of honey-based haircare.

Keep your eyes on Gisou... the fastest growing haircare brand in the world with creators 🌍

Jumping from #24 in our rankings 1st half 2022 to #5 in 2023. EMV +182% YoY!!

As reported by Fashion Network, revenue is following the same path up 10X in the last 3 years to ~$100M.

📈 2023 EMV Haircare Rankings

- US: #5 up 182%

- Europe: #5 up 231%

- Worldwide: #9 up 169%

What happened❓

Founded by Negin Mirsalehi (7M followers) and Maurits Stibbe in 2015, it grew rapidly over the years but has absolutely exploded over the last 18 months.

Enter Sarah Watt the new CEO. Occasionally, you meet someone and they just have it. Prior to joining as Chair of the Board of Gisou (18 months ago), she was the Global CMO at Charlotte Tilbury during their absolute tear up our charts.

She is a massive believer in earned media and the influencer space. It paid off for Charlotte Tilbury and it appears to be paying off for Gisou as well. Congrats to Kate Langan and the team!! This is a brand to watch and learn from.

🔍 Under the Hood - 2023 Global

- Creators - 6,474 (+41%)

- Posts - 21,623 (+49%)

- Engagements - 51.6M (+375%)

- Impressions - 703.4M (+239%)

- Retention: 151% (STELLAR)

Total EMV - $82.9M (+169%)

- Instagram EMV - $70.4M (+162%)

- Tiktok EMV - $10.3M (+294%)

- Youtube EMV - $1.9M (+76%)

Gisou 2020-2023 Growth

Gisou 2020-2023 Growth

So Long For Now

That’s it for this week—tune in next week for more insights, data, and news you can use. As always, thank you so much for reading!