Each week, we'll be bringing you select insights from our newsletter, How to Build Brands and Influence People (HBBIP). To have all of these insights delivered directly to your inbox, subscribe today!

It might surprise you to know this about a man who spends his time writing blog posts about beauty influencers, but I’m a pretty big college football fan. Or I was, at least, back when I was in college and my team of choice, the Stanford Cardinal, was actually good. Now most of my college football experience involves watching Blue Bloods like Michigan vs. Alabama and rooting for an asteroid to hit the Rose Bowl. I can’t even hate my school’s traditional rivals anymore, since my conference no longer exists. Instead, I have to get hyped up to take on *checks notes* Syracuse? Syra-scuse me?

In the midst of another largely joyless season (for me, anyway), one anthropomorphic being—and one highly creative campaign—did its part to give grumps like me a bit of hope.

Enter the Pop-Tarts Bowl, formerly known as the Cheez-It Bowl, formerly known as the Visit Florida Tangerine Bowl, formerly known as the Micron PC Bowl, formerly known as the MicronPC.com Bowl.

(Sidebar: should I rent out this newsletter for sponsorship? “How to Build Brands and Influence People, brought to you by Coca-Cola.” No pressure, guys.)

Now, I thought that the Cheez-It, a beloved four-cornered foodstuff amongst college football fans and noobs alike, was hard to improve upon, but Pop-Tarts found a way. And that way just happened to involve a somewhat frightening creature named Strawberry—a bug-eyed, preternaturally enthusiastic Pop-Tart who (that?) served as the mascot/emcee/spiritual guru for the matchup between Kansas State and my newly minted ACC nemesis, NC State. But this was no mere bystander—Strawberry stole the show, and lived up to Pop-Tarts’ claim of producing the world’s first edible mascot.

Related: These Are Social Media’s Top NBA and NHL Teams

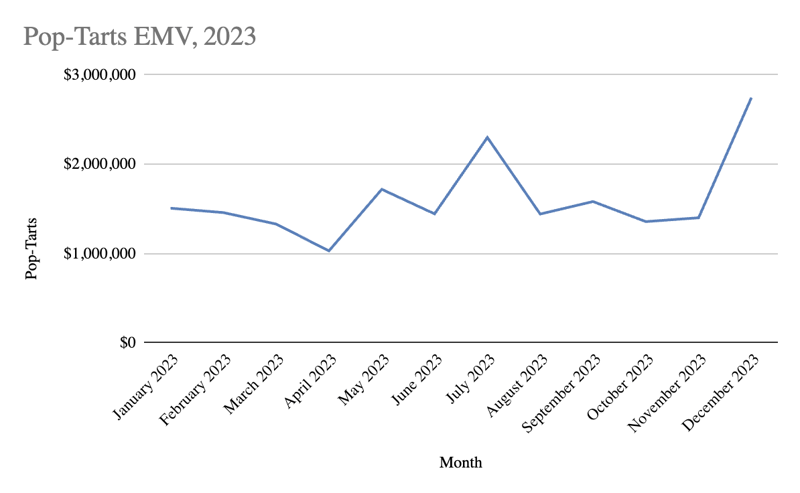

Thanks to Strawberry’s antics, which included being toasted and fed to the victorious Kansas State team after the game (much cuter than it sounds!), the Pop-Tarts Bowl was a standout moment on the college football calendar. Desperate for distraction in the listless days between Christmas and New Year’s Eve, the internet embraced the creative absurdity of Pop-Tarts’ well-crafted world, turning Strawberry into a viral sensation. Don’t just take my word for it—check out this chart!

Earned Media Value for Pop-Tarts in 2023

Earned Media Value for Pop-Tarts in 2023

That’s Pop-Tarts’ monthly EMV throughout 2023. We see that December was a clear winner for the brand, with its $2.7M EMV haul more than double its total in November. The only month that comes close is July ($2.3M EMV), when Pop-Tarts debuted a range of new flavors.

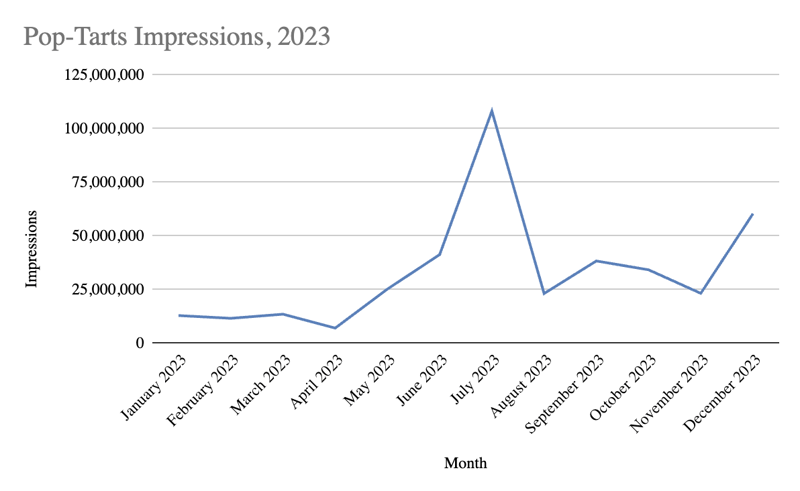

A lovable anthropomorphic mascot being roasted alive and fed to a horde of ravenous football players is pretty interesting, but from a metrics standpoint, I was expecting this to be an open-and-shut case. Pop-Tarts executed a whimsical campaign, even non-sports fans were amused, and the brand benefited accordingly. I thought I’d show a few more charts like the one above—maybe highlighting how, despite Pop-Tarts garnering more Impressions in July, December brought a meaningful surge in Engagement. Observe:

Pop-Tarts Impressions in 2023, with a notable spike in July 2023

Pop-Tarts Impressions in 2023, with a notable spike in July 2023

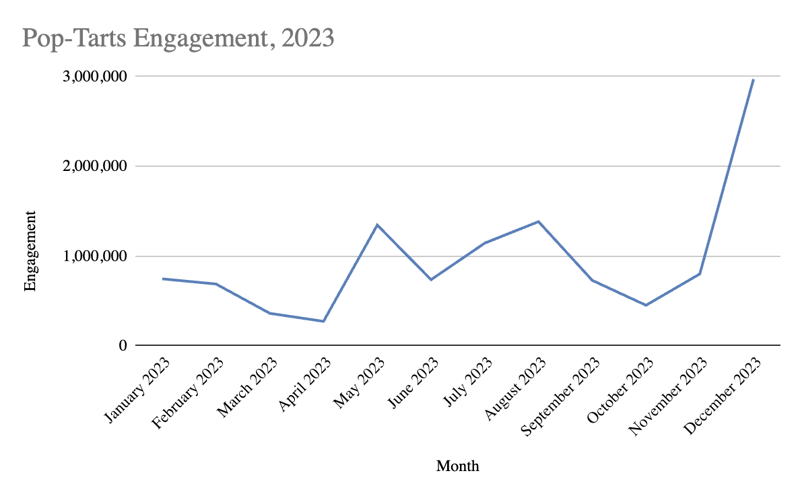

It seems that Strawberry couldn’t garner as many eyeballs as Pop-Tarts’ blitz surrounding various new flavors. However, the interwebs engaged with—liked, commented on, shared—content about the Pop-Tarts Bowl at a much higher rate.

Pop-Tarts Engagement in 2023

Pop-Tarts Engagement in 2023

The people love Strawberry, and Strawberry loved the people.

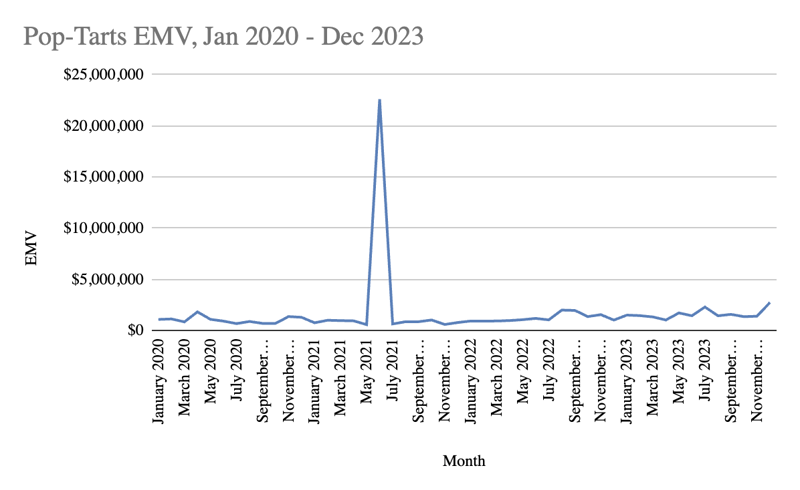

I really thought that would be it, folks—another successful newsletter, everybody pack it up and go home. Then I figured I’d check out some historical data about Pop-Tarts. Was December 2023 the brand’s best month ever? And that’s where the mystery came in, because I found something that I couldn’t explain.

Pop-Tarts historical performance, including a spike in June 2021

Pop-Tarts historical performance, including a spike in June 2021

Yep, that is indeed a seismic spike in June 2021, throwing everything else out of proportion. Pop-Tarts pulled in $22.6M EMV that month, which absolutely dwarfed its other monthly totals. But hey, my hunch was right: December 2023 was Pop-Tarts’ second-highest month, just a wee $20M EMV out of first place.

I couldn’t recall any Pop-Tarts related news from June 2021—did Strawberry appear at the NBA Playoffs or something?—so I did a little digging. But apart from seeing that the month marked the initial announcement of Unfrosted: the Pop-Tart Story, a still-to-be-released passion project from Jerry Seinfeld (no, really) that I’m sure is going to be just great, I couldn’t find a clear, sensible reason why Pop-Tarts would have spiked that month.

Then I stopped looking for anything clear and sensible, and checked out TikTok.

In June 2021, Pop-Tarts debuted its #WhatWouldPopTartsDo campaign, which encouraged TikTok creators to craft their own commercials for Pop-Tarts, built around that most eternal of questions: what would Pop-Tarts do? And the campaign went mega-viral: even posts that had nothing to do with Pop-Tarts adopted the #WhatWouldPopTartsDo tag, given its trending nature on the platform.

In all, TikTok fueled $21.3M EMV of Pop-Tarts’ $22.6M EMV total in June 2021, further proof of the platform’s ability to rocket brands to instant virality.

So what have we learned? Not only that Strawberry, and the Pop-Tarts Bowl more broadly, was a winning initiative for Pop-Tarts, but that this isn’t the brand’s first rodeo. Pop-Tarts has gone viral before, and with the bowl game set to return in December, there’s a good chance that the brand will do so once again.

Who knows? Maybe Stanford, which is now for some reason an ACC team, will be lucky enough to compete for the chance to consume Strawberry’s successor. But that would require achieving bowl eligibility first, which is a stretch. Until then, I’ll be dreaming of the good old days…perhaps with a Pop-Tart in hand.

This Week’s Headlines

In: In/Out Lists for 2024 Influencer Marketing Trends. Out: Not Doing In/Out Lists for 2024 Influencer Marketing Trends

Key Takeaways:

-

- With the In/Out trend sweeping social media, and with a new year recently upon, numerous outlets are killing two birds with one stone and publishing Trends stories using the In/Out format.

- One such example came from Vogue Business, which declared the following aspects of the Influencer Marketing game to be In…or Out:

- In:

- Video

- Authenticity

- Long-Term Relationships and Community-Building

- Offline Interactions

- AI

- Out:

- Traditional Sponcon

- Reflexive Trend-Joining

- One-Size-Fits-All Creator Strategies

- In:

The CIQ Perspective:

-

- I think this is a great roundup of where the influencer marketing space is headed, and not just because it echoes much of what CreatorIQ shared in our 2024 Influencer Marketing Trends Report.

- Having been in this space for nearly eight years—or, put another way, since Stanford football was worth a hoot—I’m seeing more video than ever, a greater shift toward authenticity (plus a greater skepticism of sponsored content), and a growing aversion to rigid, predetermined influencer marketing strategies. And since it’s 2024, we have to shoehorn AI in there somehow.

- All in all, this is one of the better trends lists I’ve seen. But you know what’s even better? CreatorIQ’s trends report! So check it out.

In: Pay Equity for BIPOC Creators. Unfortunately Also In: Lack of Pay Equity for BIPOC Creators

Key Takeaways:

- Equal pay for BIPOC creators! The industry is pushing for it, but it’s up to brands to make it happen.

- In the spirit of “it’s [insert X calendar year], this should have happened already,” Business Insider published a helpful, incisive list of concrete steps that brands can take to close this gap.

- These steps come from the Association of National Advertisers (ANA), 4As, and PR Council, three leading influencer marketing institutions.

The CIQ Perspective:

- Fair pay starts with better pay tracking. And I’m aware of at least one pretty good service for tracking/organizing/automating creator payments.

- Broad exclusivity clauses are often used to limit or otherwise harm creators’ earnings. Creators of all backgrounds should be highly mindful of contractual language, and seek representation where possible.

- Given that BIPOC creators might have a tendency to lowball themselves, it’s on marketers to offer fair rates, and to seek out more diverse partnerships.

Conor’s Corner

If there’s anyone on earth who lives, breathes, and truly believes in the Creator Economy, it’s Conor Begley: CreatorIQ’s Chief Strategy Officer, and a burgeoning creator in his own right. Conor shares his exclusive research on trending creator marketing stories with his followers on LinkedIn. But you can check out his latest findings right here.

This week, Conor shares a sparkling, effervescent brand analysis that’s sure to go down smooth—and, uh, help with your gut health.

If one of your New Year's Resolutions was to consume less sugar, then let me direct your attention to “a new kind of soda”: Olipop

The beverage brand prides itself on offering the soda flavors you love, packed with prebiotics and plant fiber, but without all the sugar.

And consumers are loving it. Olipop’s revenue surged from $31M in 2021 to $200M in 2023. A 545% growth in just two years!!!

So what’s behind this spike in sales? Has the brand’s earned media presence also (Oli)popped off this year? Spoiler alert: it has. Jan-Nov of 2023.

Olipop $49.6M EMV, +89% YoY.

Impressions are +244% YoY to 1.1 BILLION.

Total Engagements are up 302% YoY to 75.4M.

# of Influencers and # of Posts are up 40% and 24%.

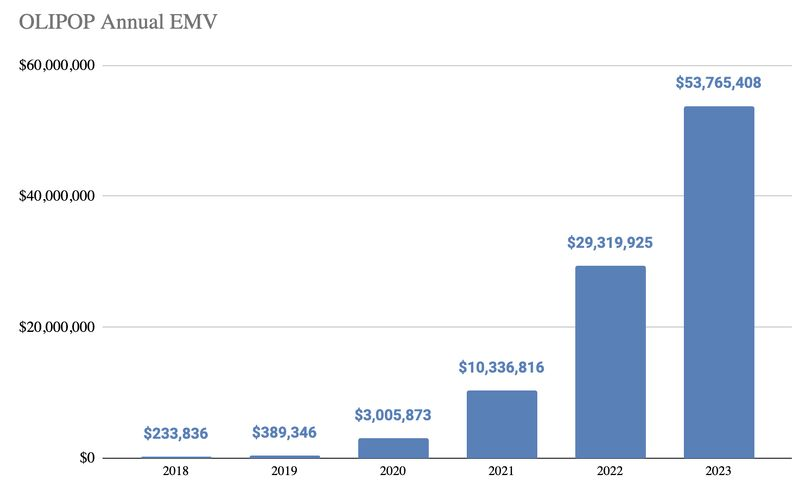

Digging deeper into the data, Olipop has been on a fast and steady climb ever since its launch in 2018:

2020: $3M in EMV, +672% YoY

2021: $10M, +244%

2022: $29M, +184%

2023: $54M, +89%

The secret to this success? Olipop leaned hard into building up its own social media presence, and fostering an impactful community of brand advocates.

On the owned media front, the team brought in creator Sara Crane to become the face of the brand on TikTok and create engaging and informative videos, which skyrocketed Olipop’s account to 333k followers and 1.9M likes.

For earned media, Olipop cultivated a community of Olipop Partners who promoted the product in their content in fun and natural ways that their audiences clearly responded to.

#OlipopPartner has since accrued 1.7 BILLION views on TikTok.

14% of Olipop’s EMV from Jan-Nov 2023 came from its top creator, TikTok sister duo @mariandcandicee, who generated $6.9M EMV for the brand across 76 posts (up from $1.5M across 18 posts in 2022) featuring a range of Olipop beverages that complemented the meals they were cooking.

Even with a quickly growing community, Olipop has great creator retention. 64% ($31.5M) of Olipop’s EMV total this year came from creators who not only mentioned the brand in their 2022 content, but also collectively increased their contribution from $18.8M EMV last year.

I think it’s safe to say that we’ll be seeing a lot more of Olipop this year and beyond.

Olipop annual EMV totals from 2018-2023

Olipop annual EMV totals from 2018-2023

To get all of these stories, plus much more, delivered to your inbox weekly, be sure to subscribe to our newsletter.