Each week, we'll bring you select insights from our newsletter, How to Build Brands and Influence People (HBBIP). To have all of these insights delivered directly to your inbox, subscribe today!

When CreatorIQ launched the HBBIP newsletter, one goal we had was providing an additional channel for Conor Begley’s Creator Facts series. Well, now those channels are cross-pollinating a bit, more blossoms are blooming, and I’m drawing inspiration from the content I was just meant to promote. How’s that for #CorporateSynergy?

The post that inspired me, and that I thought would make for a fun newsletter if explored in more detail, was this one:

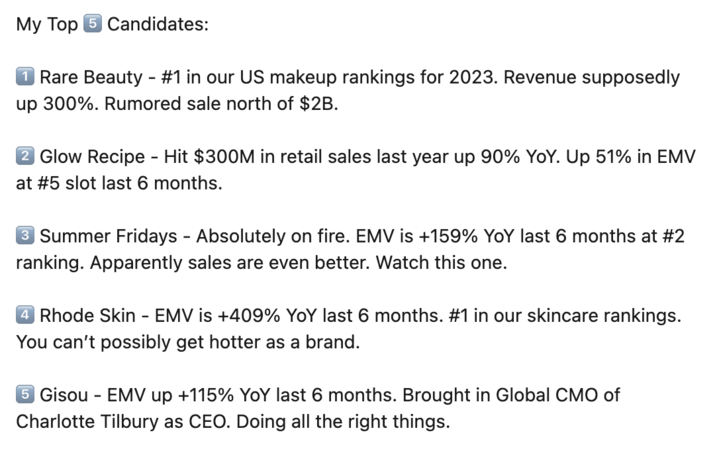

Here, Conor got in on the speculation game that’s surrounding the hottest names in Beauty, and offered his best guesses on which brands are Most Likely to Be Acquired.

It’s a tough list to quibble with: Rare Beauty, Glow Recipe, Summer Fridays, RHODE Skin, and Gisou are by any metric some of Beauty’s premier independent brands right now, and all have been the subject of frenzied acquisition chatter. But reading this list got me thinking: with each brand doing so well, which is truly doing best? And if this newsletter had to put some skin in the game and make an official prediction, what would it predict?

Does that sound interesting? Well, it better, because that’s what this newsletter is about. Read on for the deep dive!

EMV

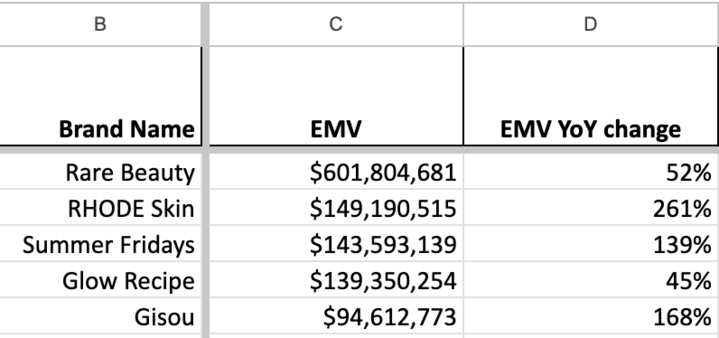

You know where we had to start things. Let’s look at the quintet’s EMV and YoY growth for March 2023 to February 2024 (I’ll be using that timeframe—the most recent data I have at press time—for all of this investigation):

EMV and YoY growth for March 2023 to February 2024

EMV and YoY growth for March 2023 to February 2024

This certainly confirms one important aspect of this analysis: none of these brands are doing poorly. So that’s reassuring. But some are doing even more not-poorly than others.

Take Rare Beauty. It might not be the fastest-growing brand in this set, but it’s hard to grow as fast when you’ve already hit the top. At $601.8M EMV, Rare Beauty’s haul is literally greater than the other four brands put together ($526.7M EMV). That’s a pretty big flex when it comes to “acquire me” energy.

But RHODE Skin’s progress can’t be ignored, either. That 261% YoY surge is massive, and it’s undeniably impressive that the brand ranks No. 2 in this set, albeit by a photo-finish margin between Summer Fridays at No. 3 and Glow Recipe at No. 4. And despite ranking No. 5, Gisou is no slouch, securing a 168% YoY growth that came in as the second-highest in this set.

Gee, it’s almost as if these are all highly accomplished brands that any acquiring party would be lucky to own. But what do I know? I’m not a financial expert. I just look at numbers and verify that some are bigger than others.

Impressions & Engagements

How many people are seeing and interacting with content about these brands? More than read this newsletter, that’s for sure :/

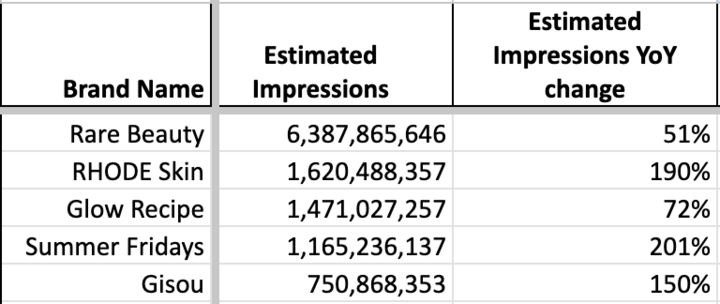

Estimated Impressions and Estimated Impressions YoY Change from March 2023 to February 2024

Estimated Impressions and Estimated Impressions YoY Change from March 2023 to February 2024

Should I start a skincare line? Would that help?

Here we see similar dynamics repeating: Rare Beauty is far out ahead of the pack by raw total, while RHODE Skin, Summer Fridays, and Gisou are our big growers. This time it’s Summer Fridays that claims the YoY growth crown, surging 201%.

It also bears emphasizing just how crazy these raw totals are: Rare Beauty content was consumed by practically everyone on earth, while RHODE Skin enthusiasts exceeded the population of India. That’s not my commentary, folks—that’s what the numbers say. And let me remind you that my job is to say whether these numbers are bigger than each other.

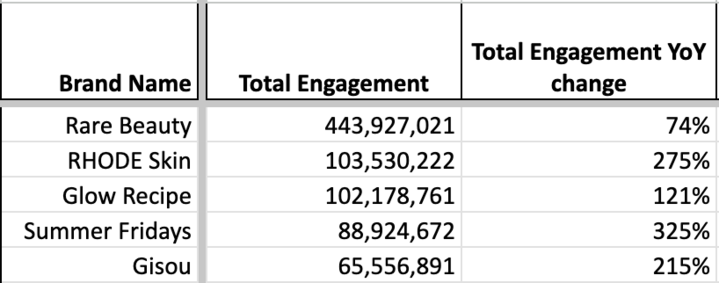

It’s pretty much the same old story for Engagements, which measures the likes, comments, and shares that posts about these brands garnered:

Total Engagement and Total Engagement YoY Change for March 2023 to February 2024

Total Engagement and Total Engagement YoY Change for March 2023 to February 2024

Summer Fridays once again comes out on top, while Rare Beauty once again leads the field in raw totals by roughly 4x.

It bears noting how every brand garnered a higher YoY growth for Engagements than for Impressions—this is a sign that these brands are capturing passion and interest, rather than just passive views. As I’ve said before in this newsletter, and as I’ll no doubt say again, Engagements growth is one of the best single indicators of brand sentiment, and brand health overall, that I’ve come across. So I can once again confirm that these are some healthy and well-liked brands.

These are the hard-hitting, cutting-edge insights for which you read this newsletter.

Community Stats

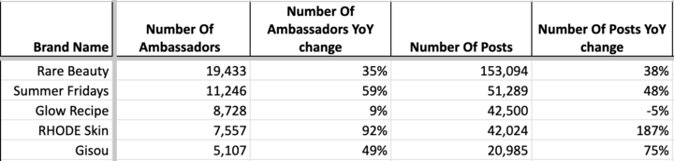

Number of Ambassadors, Number of Ambassadors YoY change, Number of Posts, and Number of Posts YoY change from March 2023 to February 2024

Number of Ambassadors, Number of Ambassadors YoY change, Number of Posts, and Number of Posts YoY change from March 2023 to February 2024

With the exception of RHODE Skin, we see less gaudy growth totals in these categories than elsewhere in this investigation. It’s actually quite impressive how these brands have remained surging despite not seeing massive community overhauls. Instead, as evidenced by that growth in Engagements I mentioned earlier, these brands are growing by continually engaging their existing communities, who are responding with steady content creation.

We also have only YoY decline amid all these various metrics, with Glow Recipe’s slight 5% drop. Again, it remains impressive that Glow Recipe managed to secure growth in other areas despite this flagging momentum.

TikTok EMV

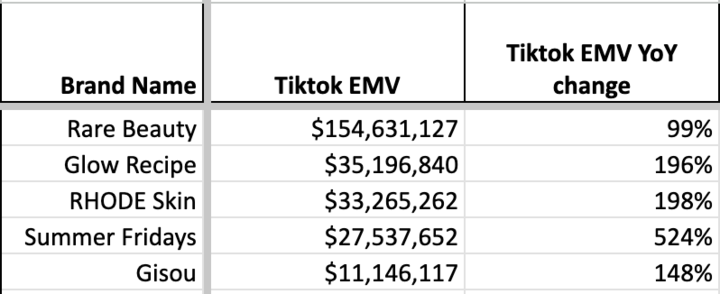

Finally, just for fun, let’s check out TikTok EMV growth. I bet it’s pretty phenomenal—can all five brands achieve triple-digit growth?

TikTok EMV and TikTok EMV YoY change from March 2023 to February 2024

TikTok EMV and TikTok EMV YoY change from March 2023 to February 2024

No, they can’t. Way to be a buzzkill, Rare Beauty—just 1% away from the dream.

Here we find that while Glow Recipe and RHODE Skin have higher TikTok totals, nobody is investing in the platform like Summer Fridays, which boasts a crazy growth rate. We also see a clear correlation between Summer Fridays’ TikTok EMV and overall Impressions growth, because as we all know, few things can spike a brand’s view total like TikTok.

Putting It All Together

So clearly we can’t go wrong with any of these brands. But which one earns the No. 1 spot?

It might not be a surprise, but I’m going with Conor (and dozens of other experts) on this one, and picking Rare Beauty. The brand is just too far ahead of every other brand in this set. Success is no guarantee in anything, much less the Beauty industry, and so for Rare Beauty to have already achieved such scale is an incredible advantage.

What really sealed it for me are the top hashtags for each of these five brands. You would expect Rare Beauty’s list:

Rare Beauty's top hashtags from March 2023 to February 2024

Rare Beauty's top hashtags from March 2023 to February 2024

But what I didn’t expect was how ubiquitous #RareBeauty would be for other brands. I haven’t seen such a thing since the Glory Days of Anastasia Beverly Hills, but #RareBeauty has become such a common and viral tag in the Beauty world that it’s ranking as a Top 10 EMV-driving hashtags for other brands.

It ranked as the No. 10 hashtag for RHODE Skin:

RHODE Skin's top hashtags from March 2023 to February 2024

RHODE Skin's top hashtags from March 2023 to February 2024

The No. 4 hashtag for Summer Fridays:

Summer Friday's top hashtags from March 2023 to February 2024

Summer Friday's top hashtags from March 2023 to February 2024

The No. 7 hashtag for Glow Recipe:

Glow Recipe's top hashtags from March 2023 to February 2024

Glow Recipe's top hashtags from March 2023 to February 2024

And the No. 2 (!) hashtag for Gisou:

Gisou's top hashtags from March 2023 to February 2024

Gisou's top hashtags from March 2023 to February 2024

More than any other brand, more than most campaigns, more than #Beauty or #Skincare, #RareBeauty has become part of the industry’s common currency. The brand’s competitors are playing on its home turf. And that dominance, more than any other single factor, is why Rare Beauty sits at the top of the acquisition chain.

To any venture capitalists reading this, I accept PayPal, Venmo, and checks.

To get all of these stories, plus much more, delivered to your inbox weekly, be sure to subscribe to our newsletter.