Each week, we'll be bringing you select insights from our newsletter, How to Build Brands and Influence People (HBBIP). To have all of these insights delivered directly to your inbox, subscribe today!

In last week’s HBBIP blog post, when I took a look at how different verticals fared in 2023, I noted that Luxury Fashion isn’t doing so hot. Remember? If you don’t, here’s a refresher:

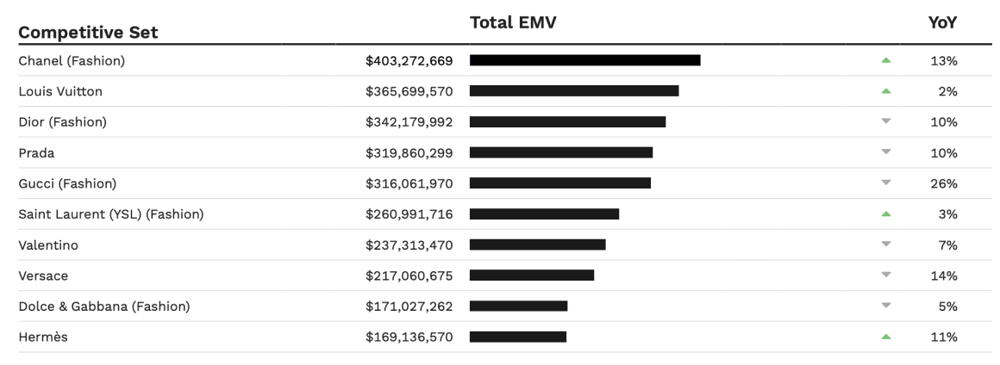

Top 10 Luxury Fashion Brands in 2023 by EMV

Top 10 Luxury Fashion Brands in 2023 by EMV

So yeah, the 2023 Top 10 was shakier than a pizza parlor. And this is reflective of the vertical as a whole over the last several years:

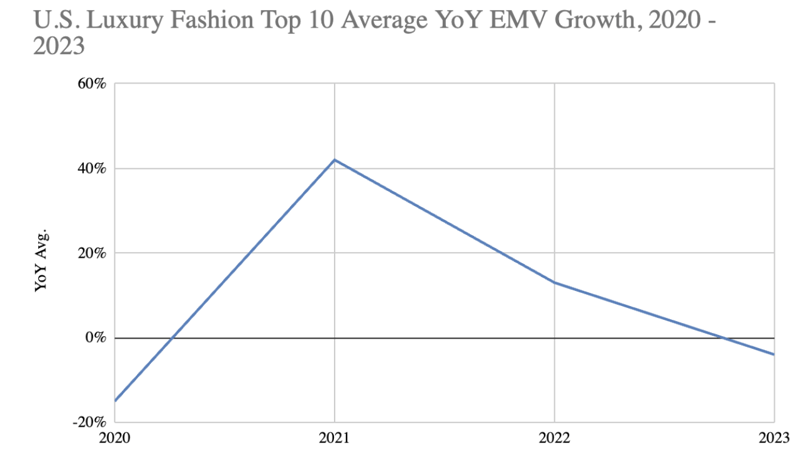

Top 10 Luxury Fashion Brands Average YoY EMV Growth from 2020-2023

Top 10 Luxury Fashion Brands Average YoY EMV Growth from 2020-2023

But what if I told you that there was a luxury fashion brand outside the Top 10 that’s reversing this trend? A brand that’s experiencing steady growth despite the broader headwinds of the industry? I would imagine that you’d want to hear more about that brand and what they’re doing well, like maybe in a newsletter or something. Boy, do I have good news for you.

Ready for the big reveal of this mystery brand?

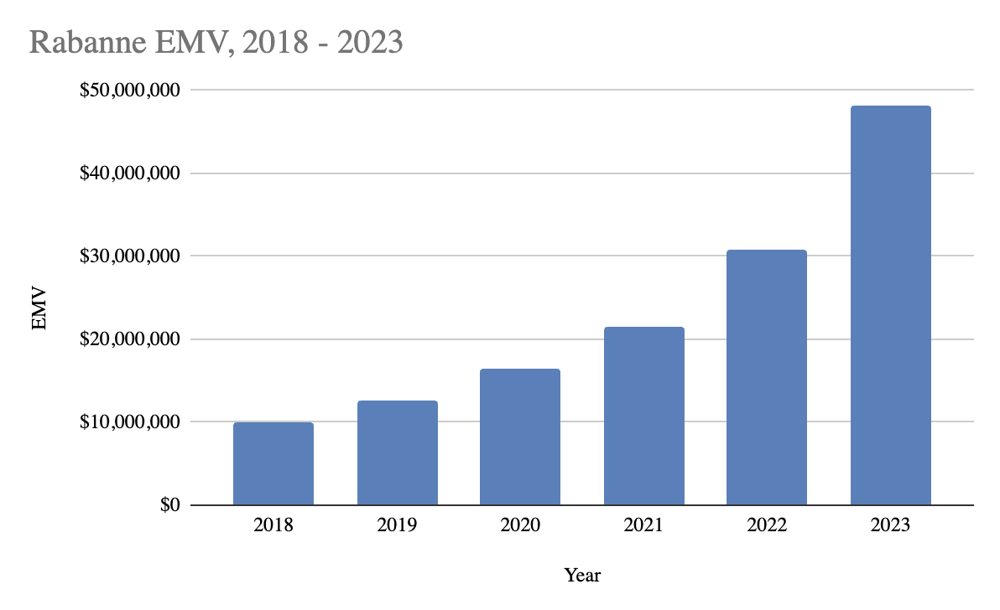

Rabanne EMV 2018-2023

Rabanne EMV 2018-2023

Boom—it’s Rabanne! If you guessed correctly, give yourself a pat on the back.

From 2018 to 2023, the luxury fashion house has stepped up its EMV every year: never backsliding, always forging ahead. There aren’t many brands in any vertical, much less Luxury Fashion, that can say the same. Rabanne even managed a 29% YoY growth in 2020, when the only other things that managed a 29% YoY growth rate were pretty grim.

Related: If Jisoo Says the Mini Lady Dior Is the Bag I Should Have, Then I Trust Her

Founded by Spanish-French fashion designer Paco Rabanne in 1966, Rabanne has long been on the cutting edge of the Luxury Fashion space, ushering in bold new innovations and a counter-cultural attitude. I also discovered about Paco Rabanne (the man) while I was doing research, and it has nothing to do with anything, but I couldn’t not include it in the newsletter, so here it is, presented without jokes or snarky commentary:

Alright then. Anyway, the brand was doing really well all through the pandemic, fueled by strong performances by its fragrance line, as well as a steady stream of celebrity partnerships. From its inception, Rabanne has worked closely with some of the biggest names in entertainment, which helped sustain the brand even amid the downturn that resulted from a lack of in-person events throughout 2020 and for parts of 2021.

But Rabanne’s crowning achievement came in 2023. The brand surged to its highest annual EMV total on record ($48.2M EMV), and boasted its highest-ever YoY growth (57%). Additionally, Rabanne made corresponding strides in its community size…

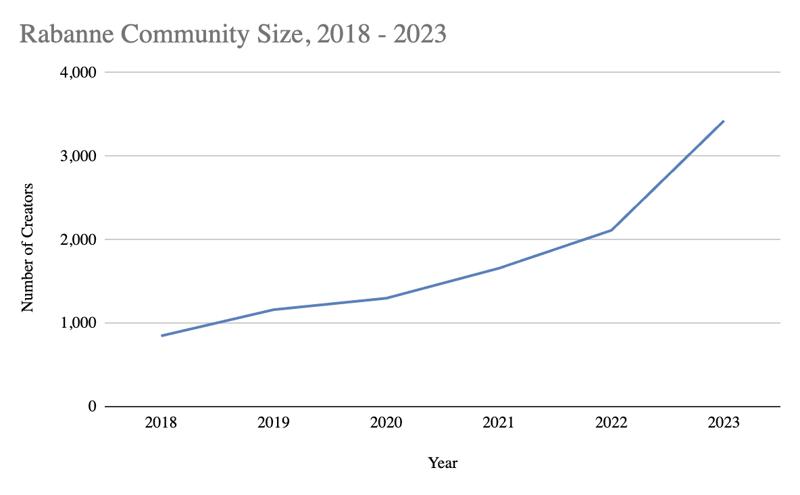

Number of Creators for Rabanne from 2018-2023

Number of Creators for Rabanne from 2018-2023

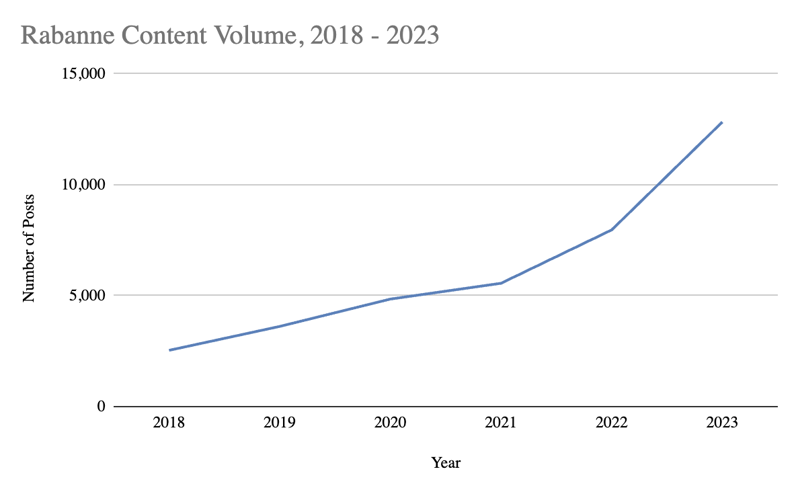

…as well as its post count, which is not technically the same graph, though you probably get the point:

Number of Posts for Rabanne from 2020-2023

Number of Posts for Rabanne from 2020-2023

Rabanne’s 2023 community was roughly four times the size of its 2018 community, while its 2023 post count was 5x what it was in 2018.

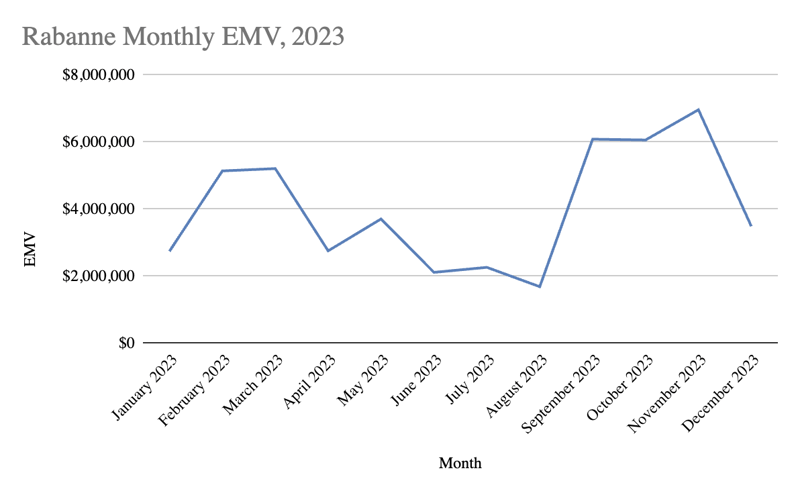

If we zoom in on 2023, a pretty clear picture emerges for the portion of the year that drove the most momentum for Rabanne:

Rabanne monthly EMV totals in 2023

Rabanne monthly EMV totals in 2023

After briefly plateauing around Fashion Week season in February and March 2023, the brand surged to new heights in September, October, and November.

Related: ASOS' Dan Elton on Why Starting at The Ground Floor and Building Internal Muscle Is Vital to Success

Having been in this whole influencer marketing game for a while, I expected the culprit for this growth to be a collaboration, or a product launch, or even a collaborative product launch. It turned out to be the latter, but I could have never guessed the partner for this collaboration:

Rabanne, famous for its superstar brand partners, avant-garde looks, and having a founder who was buddies with Jesus in a past life (okay, one piece of snarky commentary), was teaming up with H&M.

Yes, that H&M. Seemed like a strange pairing, but you know what? There’s a reason I’m writing this newsletter and not planning brand campaigns, because the partnership totally worked. Rabanne surged thanks to a splashy launch party featuring big names from across various verticals, including Madelyn Cline (acting), Nelly Furtado (music), and Cher (being an icon). This aligned with Rabanne’s broader strategy throughout the entire calendar: the brand’s post leaderboard by EMV was filled with shoutouts from luminaries in multiple fields, including Megan Thee Stallion (rap), Adele (heartbreak), Nicki Minaj (CH2-CHX)n, Lizzo (pop), and Mia Khalifa (uh, entertainment).

Faithful promotion from this powerhouse team went a long way toward Rabanne’s success, though the brand also enjoyed a boost from its newfound partner: the owned accounts of H&M ranked as Rabanne’s top EMV-driver by a wide margin, powering $1.8M EMV across 115 posts. The collab went super viral, with #RabanneHM collecting $4.1M EMV as the brand’s top 2023 hashtag—an impressive feat, given that it only generated EMV in three months out of the year.

Plenty of brands launch collaborative products, and invite creators to join them at the party. What stood out for Rabanne, and powered the brand’s success, was:

- The novelty and quality of its collaboration

- The star power of its advocates

- The multi-vertical coverage of its brand family

- How fun the party looked, and how enthusiastic creators were in their content

- I say ‘looked,’ but I was there, so I can vouch for what a great time it was. I’d share my photos, but Megan Thee Stallion didn’t like how her hair looked.

With Luxury Fashion in a bit of a lull, I’ll be looking to see which brands outside of the traditional powerhouses take a leap in 2024. While Rabanne is still a long way from the Top 10, if it keeps growing like it has, pretty soon it’ll be knocking on the door.

Conor’s Corner

If there’s anyone on earth who lives, breathes, and truly believes in the Creator Economy, it’s Conor Begley: CreatorIQ’s Chief Strategy Officer, and a burgeoning creator in his own right. Conor shares his exclusive research on trending creator marketing stories with his followers on LinkedIn. But you can check out his latest findings right here.

This week, Conor embraces his inner sneakerhead. Gee, where have I already heard about Ugg doing well?

Tip your cap to the team at Deckers. The footwear conglomerate—with a market cap of $18.6 BILLION—certainly has a knack for investing in successful brands, with a portfolio that boasts consumer-favorite comfy shoes: Ugg, Hoka, Teva, Sanuk, and more.

Let’s zoom in on Ugg & Hoka.

Deckers bought Ugg in 1995 for $14 million. Ugg generated $1.9B in revenue in 2023.

Deckers bought Hoka in 2012 for $1 million. Hoka generated $1.4B in revenue in 2023.

I’d say those paid off....

Related: Why Fall is UGG’s Time to Rise

UGG

Just like Abecrombie and other Y2K brands, Ugg has enjoyed a major comeback. In fact, Ugg’s EMV has soared 340% since 2019:

US Apparel EMV Ranking

2019: #99, $35.7M EMV

2020: #76, $49M EMV

2021: #75, $52M EMV

2022: #30, $108M EMV

2023: #17, $154M EMV (& 1.5 BILLION impressions!)

HOKA

And with the rise of the chunky sneaker aesthetic, Hoka has pretty much become a household name. The brand’s EMV has skyrocketed 898% in 4 years:

US Apparel EMV Ranking

2019: #388, $5M EMV

2020: #211, $13M EMV

2021: #150, $26M EMV

2022: #101, $38M EMV

2023: #70, $51M EMV (& 392M Impressions)

The # of influencers talking about Ugg and Hoka have also grown 184% and 1.1k% respectively since 2019.

In 2023, micro-influencers made up 65% of both brands’ communities. And unlike many brands whose EMV is more top heavy (driven mostly by large influencers), both Ugg and Hoka enjoyed a near-even split across influencer sizes. We love to see the balance!

- What got people talking?

- What got people talking?

UGG

Most of Ugg’s top-perfoming creator content featured the brand in giveaway posts during hashtag #UGGSeason (aka fall and winter), with creators gifting their followers a pair of their favorite Ugg styles (namely the Tazz slippers and Mini Platform boots).

Meanwhile, the brand’s top creators, like Ariel Gottfried and Elaina Michelle, frequently wore Ugg slippers and boots in their try-on and OOTD (outfit of the day) Reels. Ariel and Elaina contributed a respective $3.1M and $1.3M EMV, marking 132% and 632% increases from their 2022 totals.

Hoka

As for Hoka, most creators tagged the brand in their outdoor/adventure/workout/running posts, while others styled the sneakers in their trendy OOTD looks.

A common sentiment was just how comfortable the sneakers were, with TikToker Reneé Noe effusively sharing her love for the brand and asserting that she is Hoka’s “biggest fan.” Reneé was one of Hoka’s top EMV-drivers last year, generating $1.7M EMV across 41 posts.

Notably, Hoka recognized and appreciated Reneé’s brand affinity by sending her new pairs of shoes and inviting her to brand events. This effort by the Hoka team clearly paid off: Reneé’s 2023 EMV contribution reflects a 347% growth from 2022.

When creators love your brand and products, and brands show them the love right back, it’s a proven path to success. Ugg and Hoka are clearly taking that path (in comfy shoes no less), and I’d bet that it’s only going to go up from here.

So Long For Now

That’s it for this week—tune in next week for more insights, data, and news you can use. As always, thank you so much for reading!